👋🏼 Hey there. Can you do me a quick favor? Fill out our Daily Drop Annual Reader Survey – it’ll take a couple of minutes and help us tailor this year’s content to you… oh, and you might win a $50 gift card. 😉

☀️ Goooood morning and welcome to our first full week of the year! Things are slow in the points and miles world, but we’ve still got plenty to talk about.

Here we go:

😬 Major flight disruptions in the Caribbean

So, apparently, the U.S. is now at war with Venezuela? Or something?

We won’t get into the details of whatever is happening with that… but there are some major implications for travel.

For starters, U.S. and European airlines have delayed and canceled some flights to various Caribbean destinations, even those that aren’t super close to Venezuela.

But even if you’re just not feeling super comfortable traveling to that region right now, airlines are offering waivers to cancel and rebook flights, even if you’re booked into basic fares.

Here are some links, but just search on Google for other airline pages:

Some of these only apply to flights originally booked through January 4, while others (like Delta and United) apply to flights booked later.

I’m writing this on January 4, so the policies could also change, and the eligible date ranges could be extended.

By the time this gets published, flight operations might be back to normal… but just in case this gets drawn out, hopefully these resources help you.

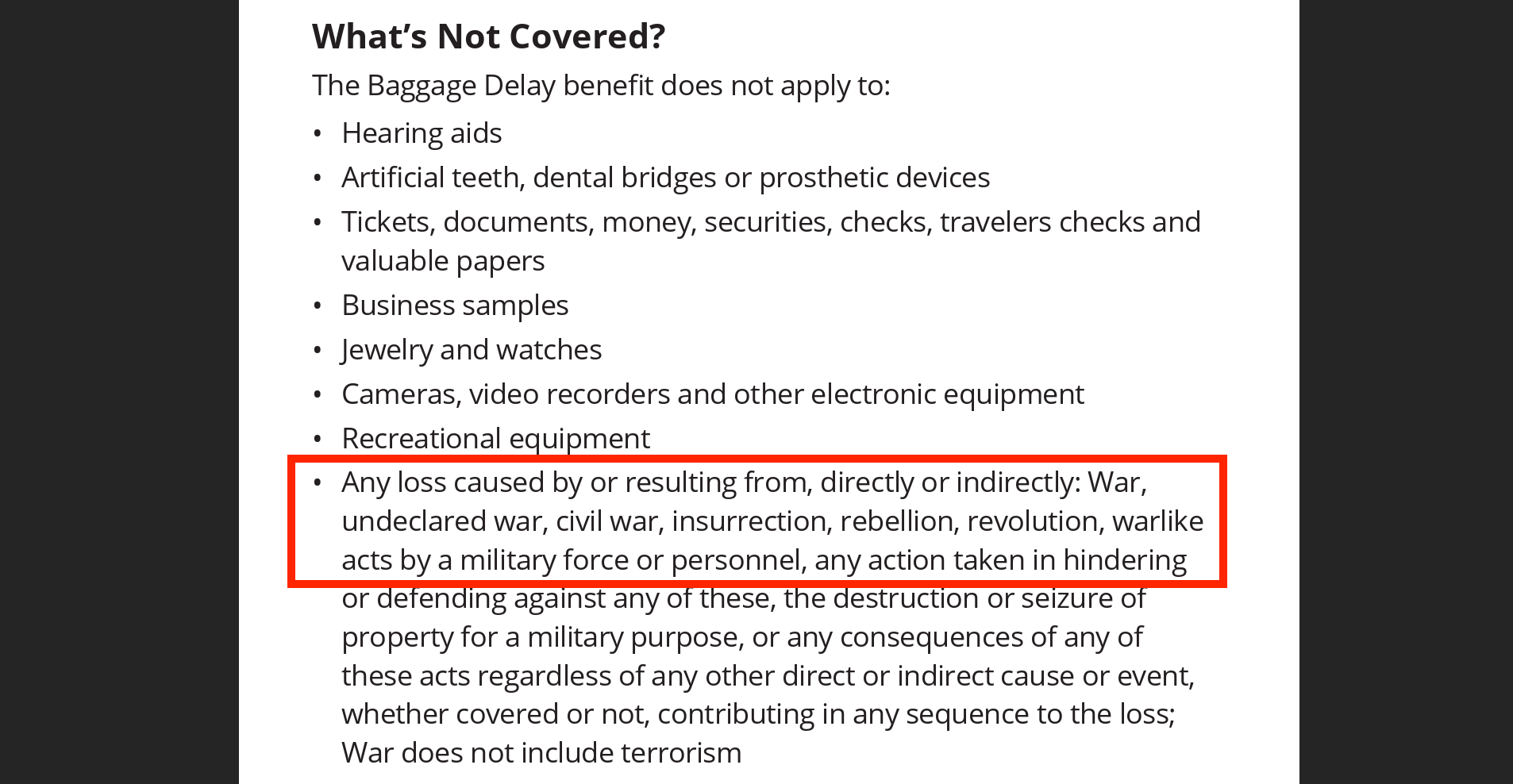

Another thing to note is that normally, I’d advise you to look into your credit card travel protections in cases like this.

But this time, you’ll probably be out of luck. Most travel protections have some kind of exclusion for this type of situation:

The credit card companies saw this one coming

Still, it could be worth submitting claims with your provider if you run into any travel mishaps, as they could potentially reimburse you or interpret the situation differently.

Anyway, good luck out there, folks. Now back to our normal fun stuff:

💳 My favorite underrated hotel card

Last week, I told you about my elite status plans for 2026.

Even though I spent just 12 nights at Hilton hotels last year, top-tier Hilton status is something I have every year.

That’s because I hold the Hilton Honors American Express Aspire Card.

And to be honest? I’d keep it even if I only spent 2 or 3 nights a year at Hilton. Because it’s just a damn good card.

Here’s why:

The credits alone make it worthwhile

Again – I don’t live in the U.S. and don’t stay at a lot of Hilton hotels… but the credits for this card just make sense.

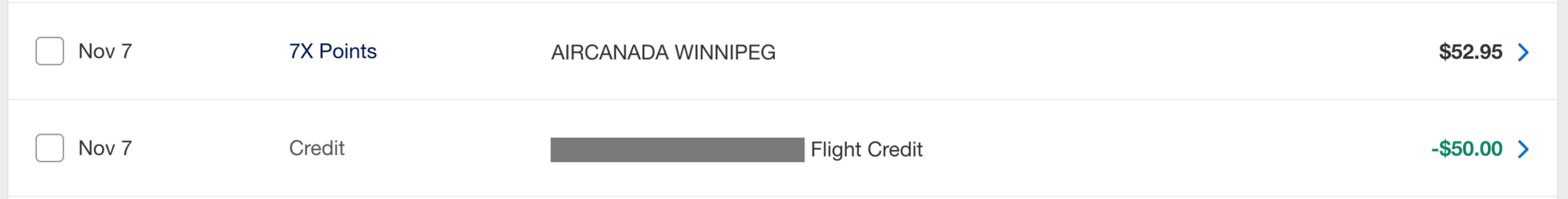

For example, the card comes with $200 of annual airline credits ($50 per quarter).

These credits can be used with ANY airline in the world, even for taxes and fees on award tickets.

My most recent use of this credit was to book an Aeroplan award flight with just over $50 in taxes and fees.

Example of using the $50 airline credit

Needless to say… these credits are as good as cash for most people, which takes an easy $200 off the annual fee.

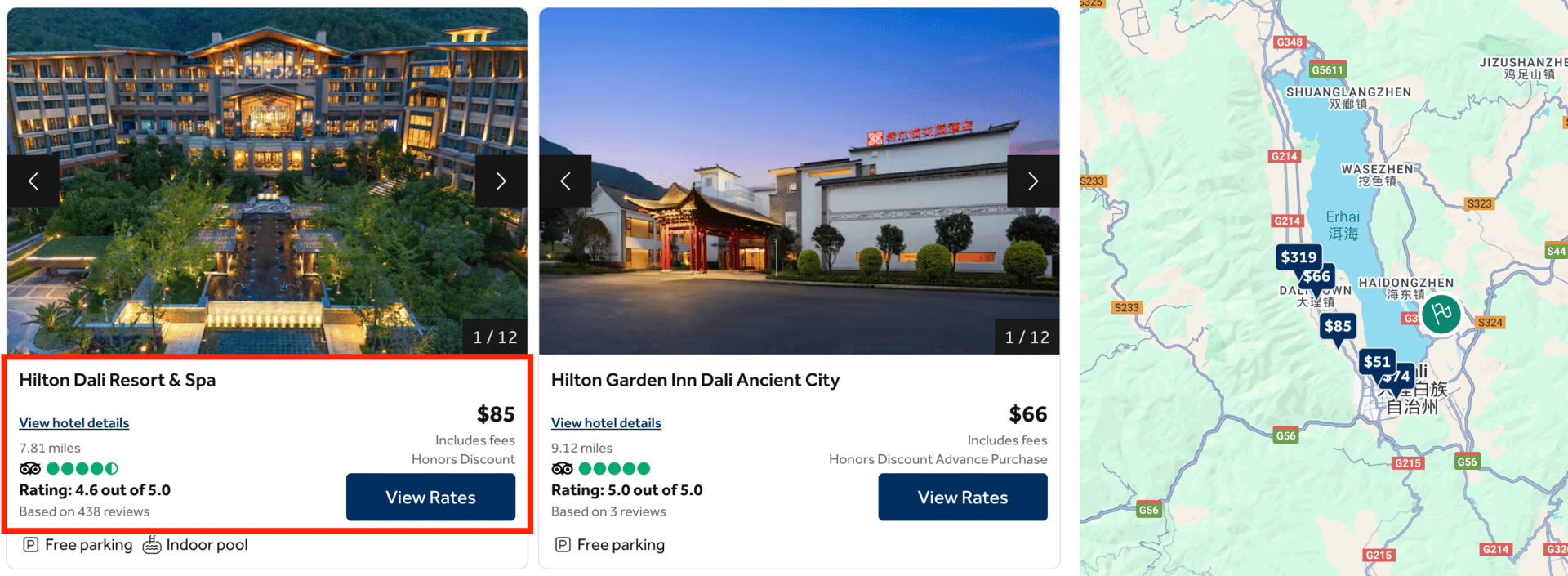

Next up is the $400 of annual Hilton resort credits ($200 every six months).

And these might be more useful than you think… Hilton has a huge list of resorts all over the world, some of which aren’t your typical “expensive beach resort” vibe at all.

For example, I just used my resort credit a couple of months ago to book two nights at this Hilton hotel in Dali, China, which is technically a resort, and costs just $85 per night.

Hilton resort in Dali, China

I’d normally be okay paying $85 a night for a nice hotel, so this felt pretty close to cash for me.

The stay only cost $170, so I even got a nice steak dinner at the hotel – putting my total charge just above $200.

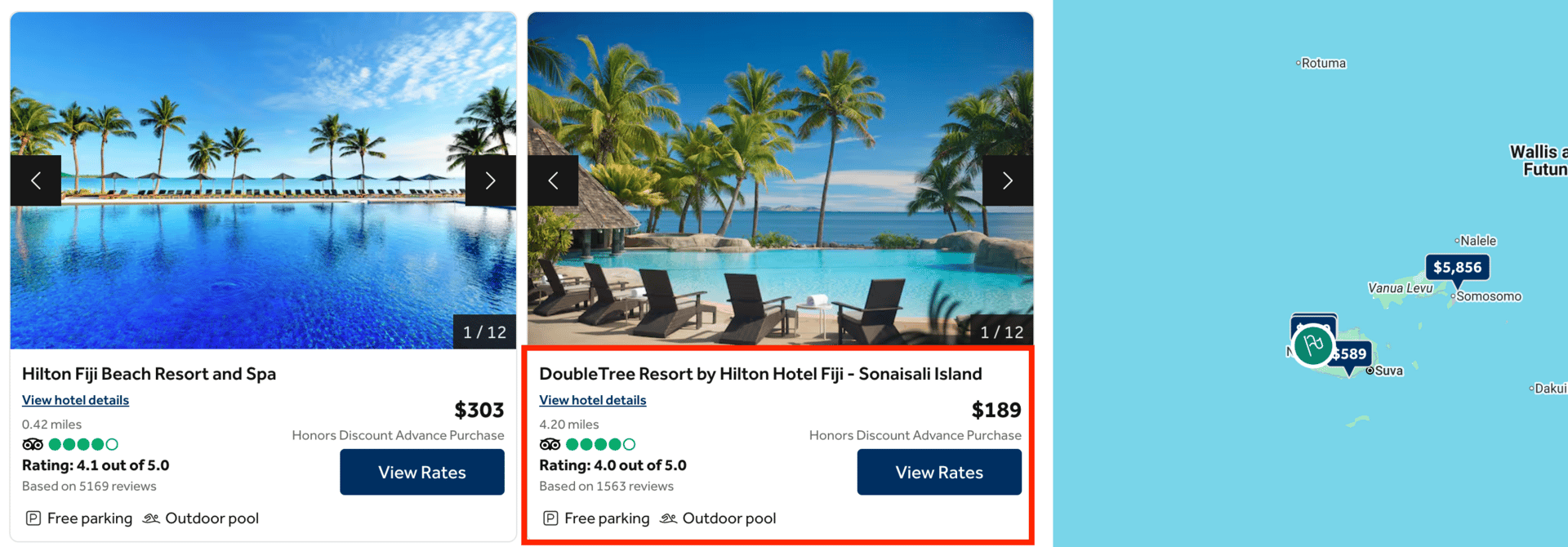

Earlier last year, I used my other $200 credit to book a night at this Hilton resort in Fiji during an overnight layover. 👇

Hilton resorts in Fiji

It turned my 18 hours in Fiji into more than just a layover, which was really cool. After taxes, I paid around $10 out of pocket for this stay.

Here’s what else I love about this credit:

Hilton has a page on their website that specifies every hotel in the world where this credit will work – organized by both brand and region.

They don’t make it vague and difficult to use, but quite the opposite. How refreshing, eh?

The point is this:

Those credits alone are worth more than the annual fee of the Hilton Amex Aspire… but on top of all of that, the card also has meaningful perks.

The perks, baby

The most important perk is the card’s annual Free Night Certificate, which can be used at almost ANY Hilton hotel in the world, as long as there’s a standard room available.

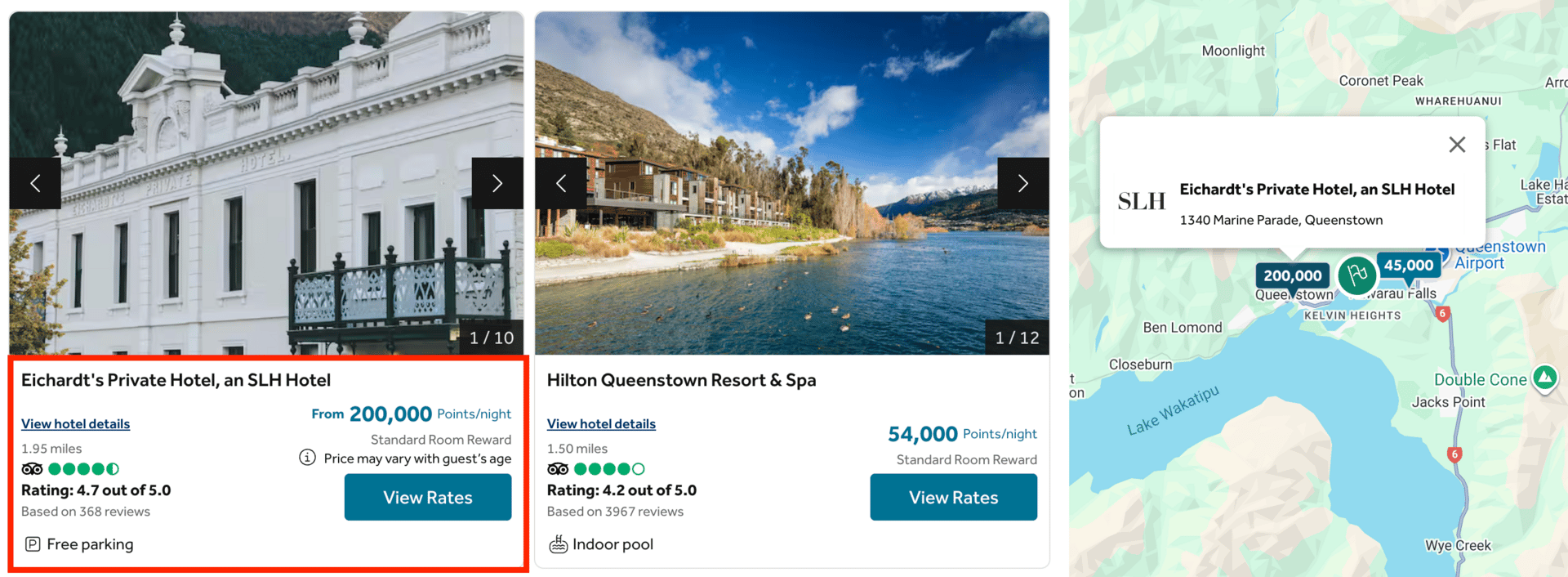

I used my Hilton FNAs earlier this year to stay at Eichardt’s Private Hotel in New Zealand, which costs 200,000 points per night (yes, even for a standard room). 👇

Hotel in Queenstown for 200,000 Hilton points per night

The Hilton Amex Aspire also gives you automatic Diamond status – which comes with free breakfast, lounge access, and possible suite upgrades on those stays you book with your credits and free night awards.

💡 Fun Tip: Those $400 of resort credits also earn you points from spending at Hilton hotels. Since you earn 10x from being a member, 10x from Diamond status, and 14x for spending with the Hilton Amex Aspire, you’ll earn a minimum of 13,600 extra points per year just from using those hotel credits… which is a fun little bonus.

Welcome offer

Oh, did I mention the card currently has an elevated welcome offer?

So on top of ALL of the things I just mentioned, you can earn 175,000 Hilton points for signing up for the card (the offer ends next week, FYI).

So yeah… this card looks like it might be for die-hard Hilton fans at first glance.

But for me? It’s a way to get some free airfare, a handful of nice stays every year, and solid perks to enjoy during those stays.

🧘🏼♂️ Get 100% back on Calm (free points)

I’ve said it a million times, and I’ll say it again: Merchant offers are one of the best ways to get consistent value from your cards year after year.

Sometimes, offers pop up that let you effectively get free points.

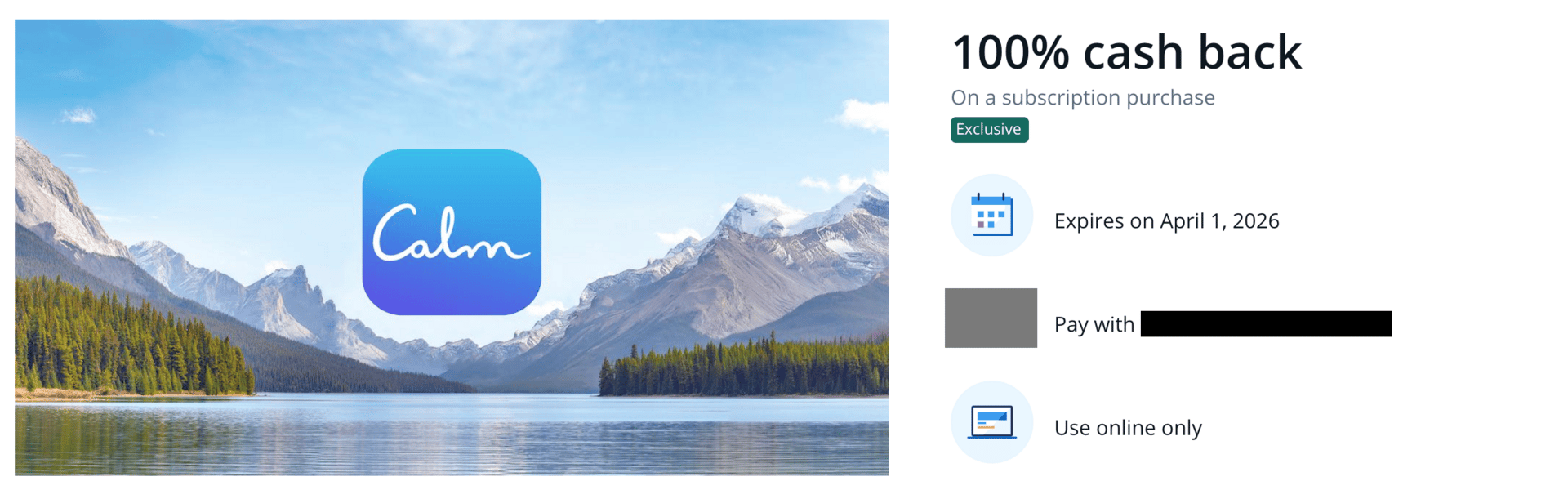

For example, right now I have an offer on the Chase Sapphire Reserve® to get 100% back at Calm.

It’s funny – I used to use Calm every single day. I used it for years and at some point just stopped.

Anyway, getting 100% back on an annual subscription (including taxes) is a great way to get back on the horse and see if I still enjoy it.

Plus, the $91 expense will earn me some points. Not many, but that’s where the stacking comes in. 😈

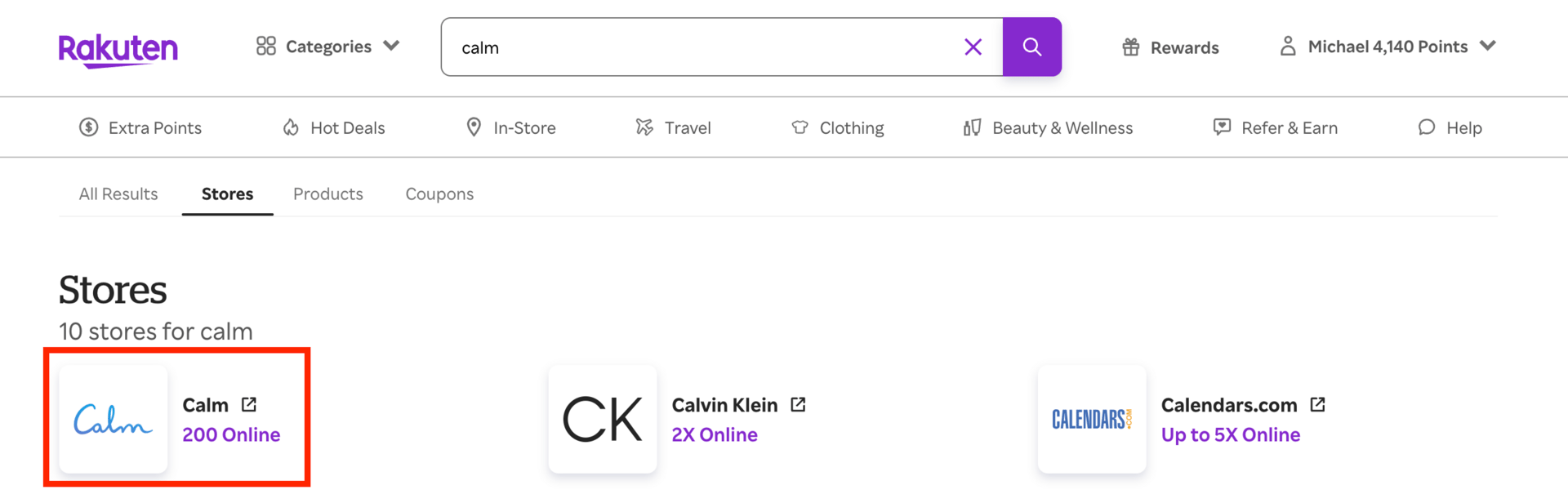

Rakuten is currently offering 200 points for clicking through their link and signing up for Calm. 👇

So now you’re getting a free year of Calm and around 300 free points.

Here’s where offers like this really shine, though:

If you see this offer on a card you recently signed up for, this is basically $100 of free spend toward hitting the welcome offer.

If you do this, it’s important to make sure you do a few things:

Always use a portal if you can

Make sure to activate the offer and add it to your card

Either cancel the subscription right after signing up or set a reminder to do so before it renews (unless you want to continue paying for it)

Check your accounts to see if you have any other fun offers!

📱 7 travel apps you need to download

We live in a crazy era for travel. We have so many tools and apps to help us navigate the world around us, making travel easier and more accessible than ever.

In this week’s Daily Drop YouTube video, we’ll show you seven of the best travel apps we can’t live without. 👇

That’s all for this Monday, folks! Stay tuned the rest of the week for more travel fun times.

Take care and see you tomorrow,

With contributions by McKay Moffitt