💙 TRENDING TRAVEL NEWS ❤️

• It’s Official: Southwest’s assigned seating is here, friends.

• Noted: Visiting these countries? Tipping is rare (or not expected at all).

• Heads Up: Bangladesh travel advisory was issued by the U.S., so check before booking.

• Railway Fans: Trains are back — Amtrak saw its highest ridership ever in 2025.

Good morning from Manchester, New Hampshire, where I’m using the ultimate classic travel hack: crashing on my friend’s couch.

We’ve got a fun one for you today:

💳 One-card strategy: family edition

Learning the ins and outs of points and miles can be… exhausting.

We live in a world with so many apps and accounts to manage, and points and miles (and especially credit cards) can be one more tedious thing.

So I think it’s worth reminding you that you don’t need to overcomplicate things. I think just about everyone can benefit from a one-card setup that suits their needs.

And today, I want to tell you about a one-card setup that could work well for family travelers.

The Card

I think the Capital One Venture Rewards Credit Card is a perfect card for family travelers who value simplicity.

And no, it’s not just because it currently has an elevated welcome offer, though that definitely helps.

The Venture Card has a low annual fee, super-simple earning rates, and flexible redemption options for multiple travelers.

Transfer partners

One of the reasons this card works so well for families is Capital One’s set of transfer partners.

For example, you can transfer points to Flying Blue, which offers a 25% discount on award flights for children ages 2-11.

So a flight to Europe that normally costs 25,000 miles will cost just 18,750 miles.

Add that up for multiple kids flying round-trip, and that’s some serious savings.

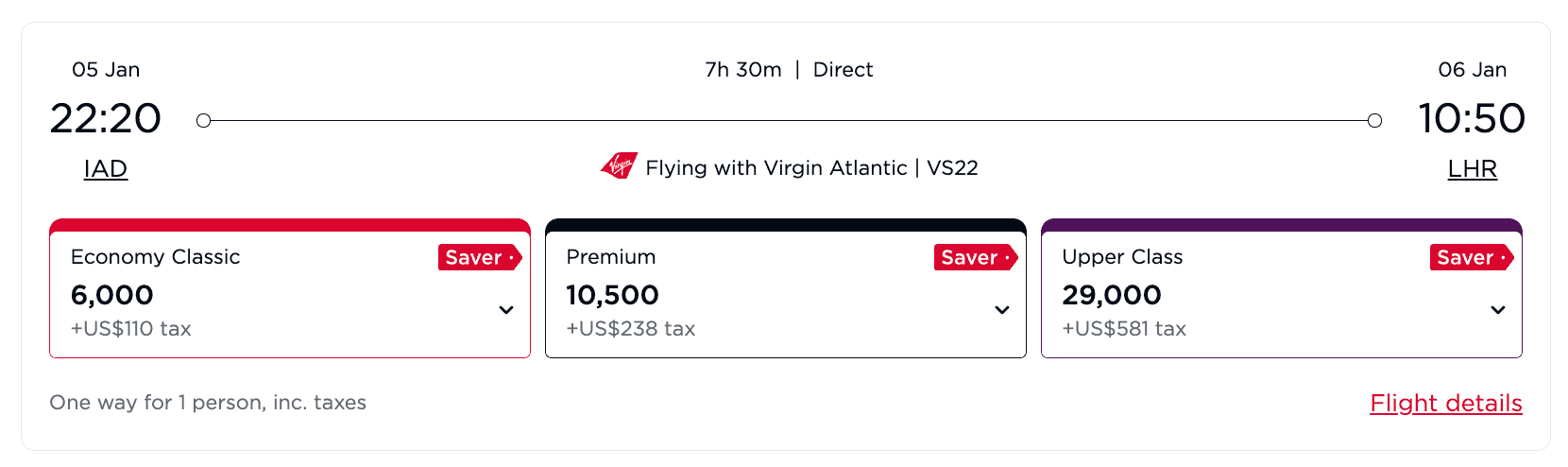

Another great transfer partner is Virgin Red (and Virgin Atlantic), which lets you book flights from the U.S. to London for as few as 6,000 miles each way.

Virgin’s site is down today, so I pulled this example from earlier this month

It’s pretty awesome when one low-fee card can get a family of four or five people to Europe (round-trip) without breaking the points bank.

Flexible redemptions

One of the problems with transferring points to hotels is that you’re subject to occupancy limits. When you have a family, that means booking multiple rooms and shelling out double the points.

With Capital One miles, however, you can offset any travel purchase at a rate of one cent per mile.

That means you could book a vacation rental with multiple bedrooms through any website you want and use your miles to offset it.

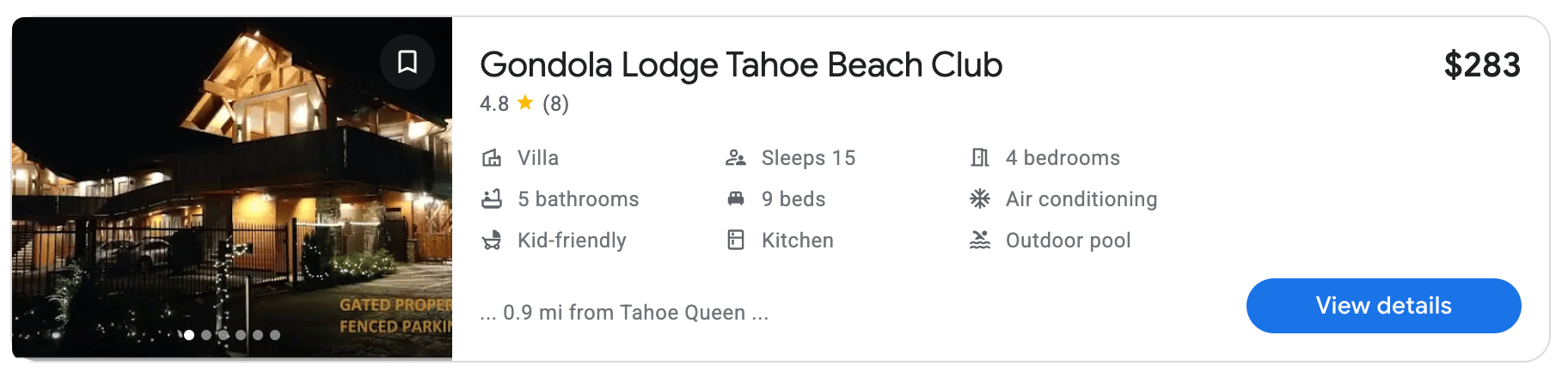

For example, this villa near Lake Tahoe can sleep 15 people and costs $283 per night.

Vacation Rental in Tahoe

You could bring your whole family (and extended family) there and use just 28,300 Capital One miles per night to cover the cost.

Good luck booking accommodations for that many people and that few miles with transfer partners. 😉

Simple earning rates

The Venture Card earns 2x miles on ALL purchases. Is that the best you’ll get on certain types of spending? No.

Is it incredibly simple? Yes.

Plus, if you have a family, you’re probably spending money on back-to-school gear, tuition, and other categories that most other cards would only earn 1x miles on.

So for families, this simplified structure might even put you ahead.

Bottom line

You don’t need to overcomplicate your life to play the points and miles game.

One simple, low-fee card could unlock a lot of travel without a lot of stress – even when you’re booking for the whole fam.

🏨 My favorite Bilt Rent Day yet

Bilt is back with its first Rent Day promotion since launching Bilt 2.0. And while I’ve definitely been giving Bilt some flak recently, I think this Rent Day is realllyyyyy exciting.

The highlight is a one-time transfer bonus to Accor Live Limitless, which is an extremely valuable program.

Photo by Bilt

Here’s how it works:

Depending on which Bilt status you have (even if you have no status), you’ll get a tiered transfer bonus to Accor, available only on February 1.

Since the normal transfer ratio from Bilt to Accor is 3:2, the numbers get a little messy… Here is the breakdown:

Status Tier | Transfer Bonus % | Final Transfer Ratio |

|---|---|---|

Blue (no status) | 25% | 6:5 |

Silver | 50% | 1:1 |

Gold | 75% | 6:7 |

Platinum | 100% | 3:4 |

As you can see, even Bilt members with no status (Blue tier) will get a 25% transfer bonus.

Personally, I think even transferring Bilt points to Accor with no bonus is a good idea. So having any bonus just sweetens the pot.

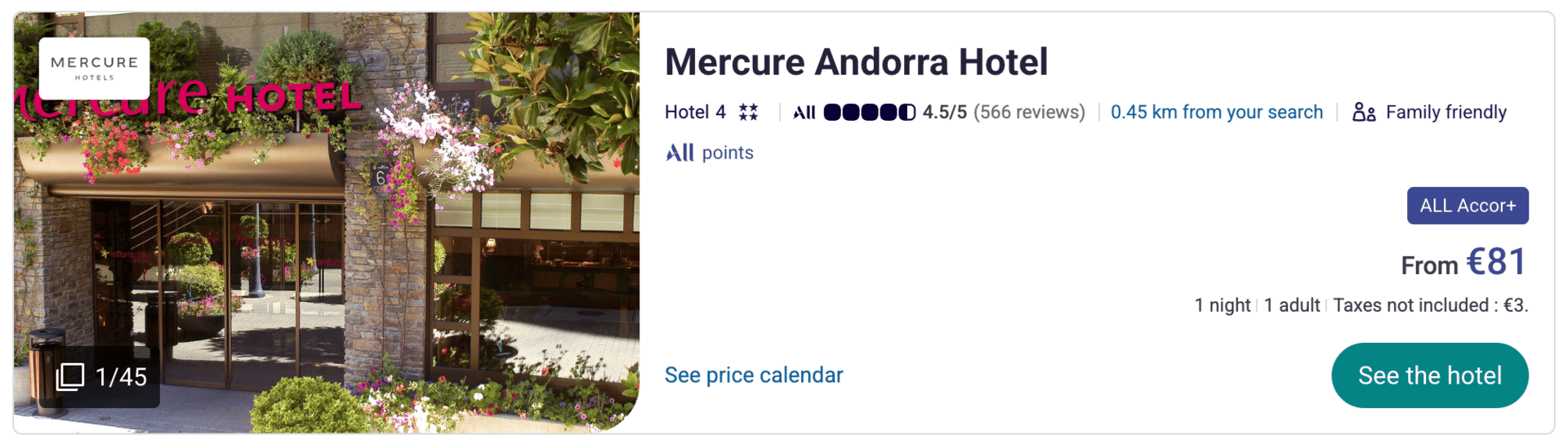

For example, I was just eyeing some hotels in Andorra (it’s a country, look it up).

Accor is the only chain with hotels there, and this 4-star Mercure hotel costs about €84 per night, including taxes:

Since Accor points are worth a flat 2 Euro cents each, I can book this hotel for a flat 4,000 points per night (and then pay 4 Euro cash).

With Bilt’s transfer bonus, even free members will be able to book hotels like this for just 4,800 Bilt points.

If you have a higher tier of Bilt status, those numbers just get even better.

And for the first time ever, you have the chance to upgrade your Bilt status to unlock one of those higher bonuses.

For $75 of Bilt Cash, you can get a one-time status bump to the next highest tier of status. Top-tier Platinum members can do the same to unlock a 125% transfer bonus as well.

If I had Bilt points and Bilt cash, I’d definitely use them for this purpose. I have many stays booked with Accor right now and think this is a solid opportunity.

This deal is only valid on February 1st. So if you think you could benefit from it, mark your calendars and don’t miss out.

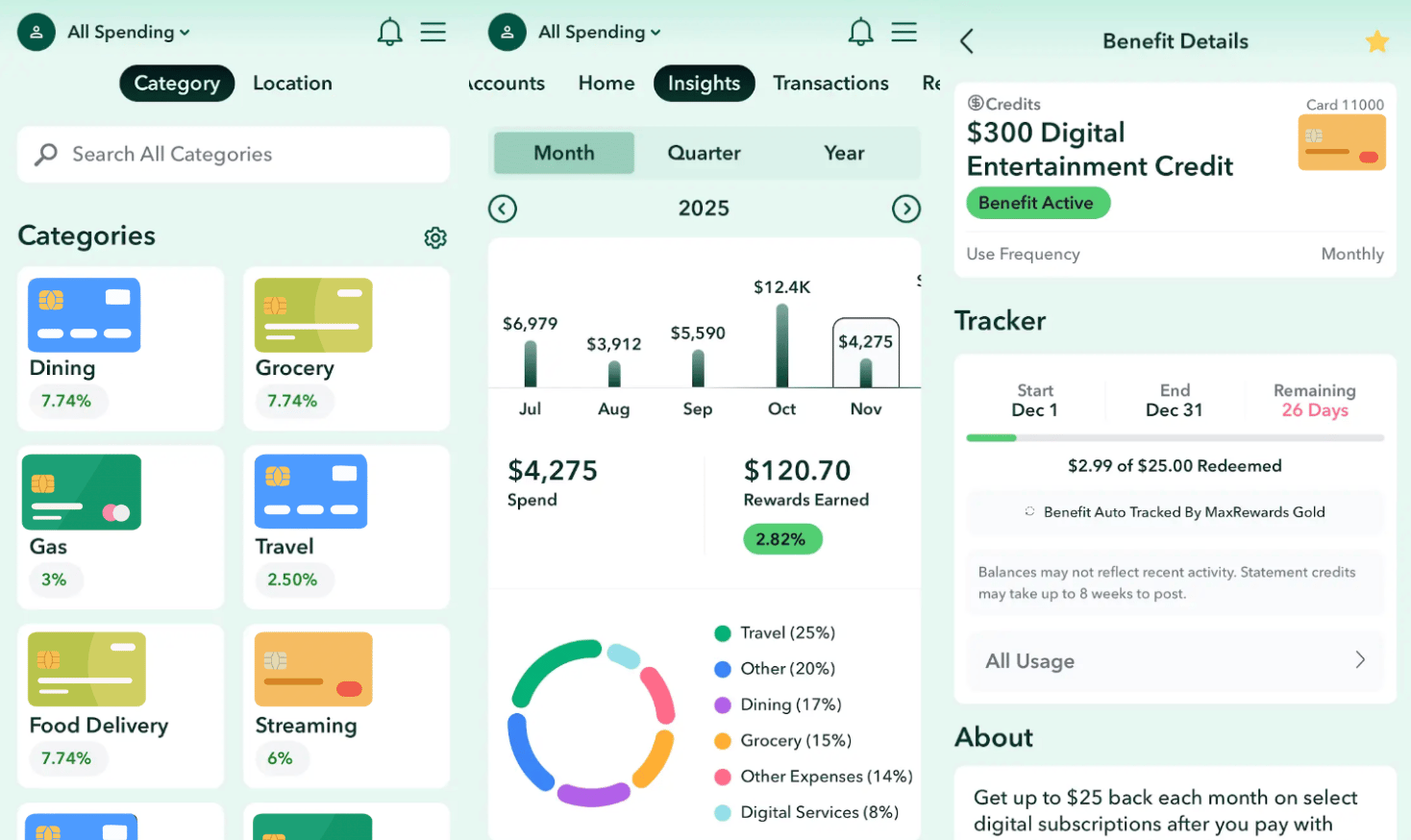

PRESENTED BY MAXREWARDS

💳 The app that’s kept my points and miles brain sane

If you’ve been here long enough, you know I’m a “get a million welcome offers and wonder why I own 19 cards” kind of person. It’s part of the job… but also part of the chaos.

Some years ago, that chaos finally caught up to me. I missed a credit, mis-timed a welcome offer, and realized I had become that person: the travel guy who can’t even track his own cards.

So I swallowed my pride and downloaded MaxRewards — and honestly, it’s been my secret weapon ever since.

Photo by MaxRewards

It pulls in all my cards from all my banks (in like… two minutes), and suddenly everything that lived in 16 spreadsheets was just there.

Which card earns the most for whatever I’m buying? It tells me.

Which merchant offers are active? It handles those automatically.

Am I about to fumble a welcome offer? MaxRewards tracks that too.

How much value am I getting from rewards? It crunches the numbers

But the real MVP for me is how it organizes all those random annual credits. I haven’t let a single one slip through the cracks since I started using it — and that alone pays for the subscription.

And because you’re a Daily Drop reader, you get 25% off their annual Gold plan, plus a seven-day free trial. Use code dailydrop below. 👇

That’s gonna finish things off for today, my friends. I hope you learned a thing or two and that some of you can leverage that crazy transfer bonus.

Have a lovely day, and I’ll see you tomorrow. ❤️

With contributions by McKay Moffitt