If you’ve been reading Daily Drop for a while now, then you know how much we love the Chase Sapphire Preferred® Card. And while that card is wonderful and beautiful and amazing, there’s another (very adjacent) card that doesn’t get the love it deserves.

I’m of course referring to… the Capital One Venture Rewards Credit Card.

Right now, this Annual Fee: $95 card is even sweeter, due to its limited-time welcome offer: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel.

That is a very generous stash of points, and unlike some cards, Capital One doesn’t make you jump through hoops to use them. So instead of talking about “potential value,” here are five real trips you could book using this offer alone.

How Many Miles Are We Actually Working With?

Here’s a conservative, very normal scenario for most of you:

75,000 miles from the welcome offer

8,000 miles from hitting the $4,000 minimum spend (because 2x miles on everything)

10,000 to 15,000 miles from everyday spending

$250 Capital One Travel credit

That puts you at roughly 95,000 to 100,000 miles, plus $250 that can be used on flights, hotels, or rental cars booked through Capital One Travel.

So with those numbers in mind, here are some travel options for you and yours.

1. Italy for Two (Rome and Florence)

Italy is on like… everyone’s travel list. And honestly, it’s one of the best examples of how Capital One miles work in practice.

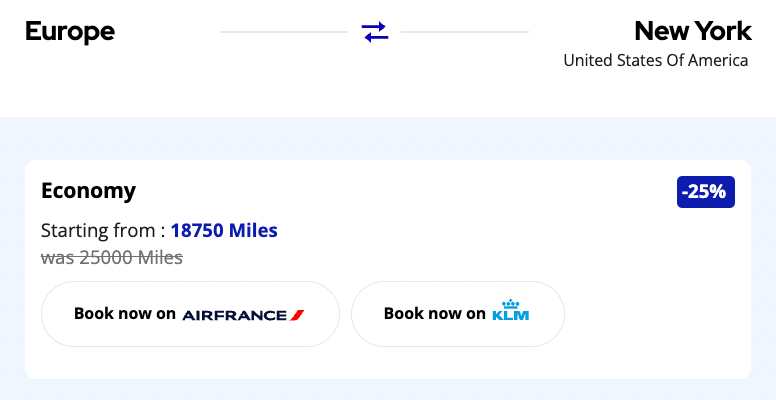

Capital One miles transfer to Flying Blue (Air France and KLM’s loyalty program), where economy flights to Europe (sometimes including Rome or Milan) start at 18,750 miles one way.

New York (JFK) to Europe for 18,750 in economy

That means two people can frequently fly round-trip to Rome or Milan using most of the welcome offer alone.

From there, it’s easy to build a simple multi-city trip. Fly into Rome, take the train to Florence, and return from whichever city has better availability.

The $250 Capital One Travel credit fits in well here, since you could use it for:

a hotel night in Florence

a rental car in Tuscany

or part of the taxes for your return flight

👀 Pro Tip: Flying Blue releases monthly Promo Rewards with discounted award rates. You shouldn’t necessarily wait around for these, but if Italy shows up, the same trip could cost even fewer miles.

2. Japan

Japan is… also on everyone and their mom’s list (for good reason). And, it’s where Capital One’s flexibility really earns its keep.

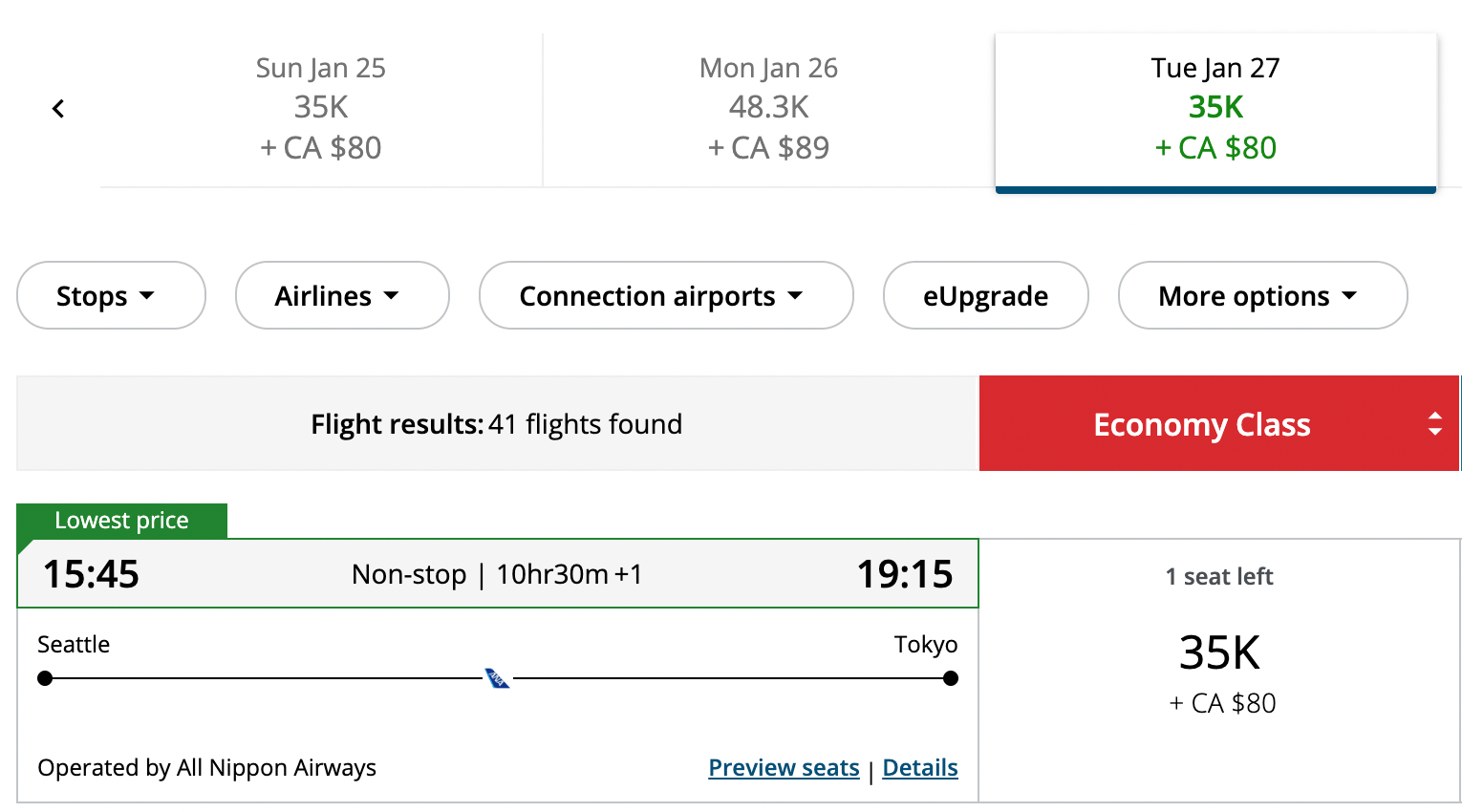

If you want to maximize your value here, you can transfer Venture miles to Air Canada Aeroplan and book economy flights to Tokyo for around 35,000 miles one-way (when you can find availability).

Seattle (SEA) to Tokyo (HND) nonstop for 35k Aeroplan points via ANA

So yeah, this is already an incredible points deal, but you don’t have to transfer.

If you find a solid cash fare (say $900 to $1,000 round-trip), you can book it directly with your Venture Card and cover the charge using miles at one cent per mile.

Then use the $250 travel credit to:

offset a hotel night in Tokyo

cover airport transfers

or knock down taxes and fees

👀 Don’t Miss: How to pay for literally anything with points.

3. Patagonia (Chile or Argentina)

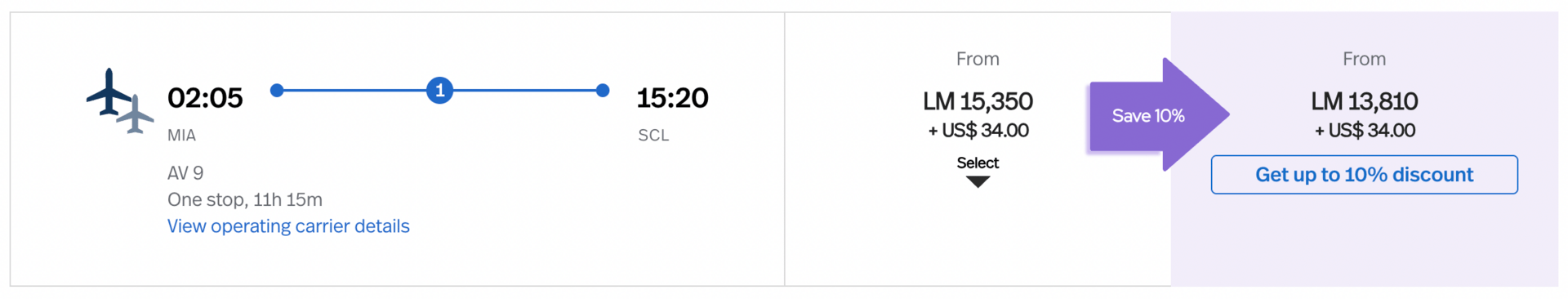

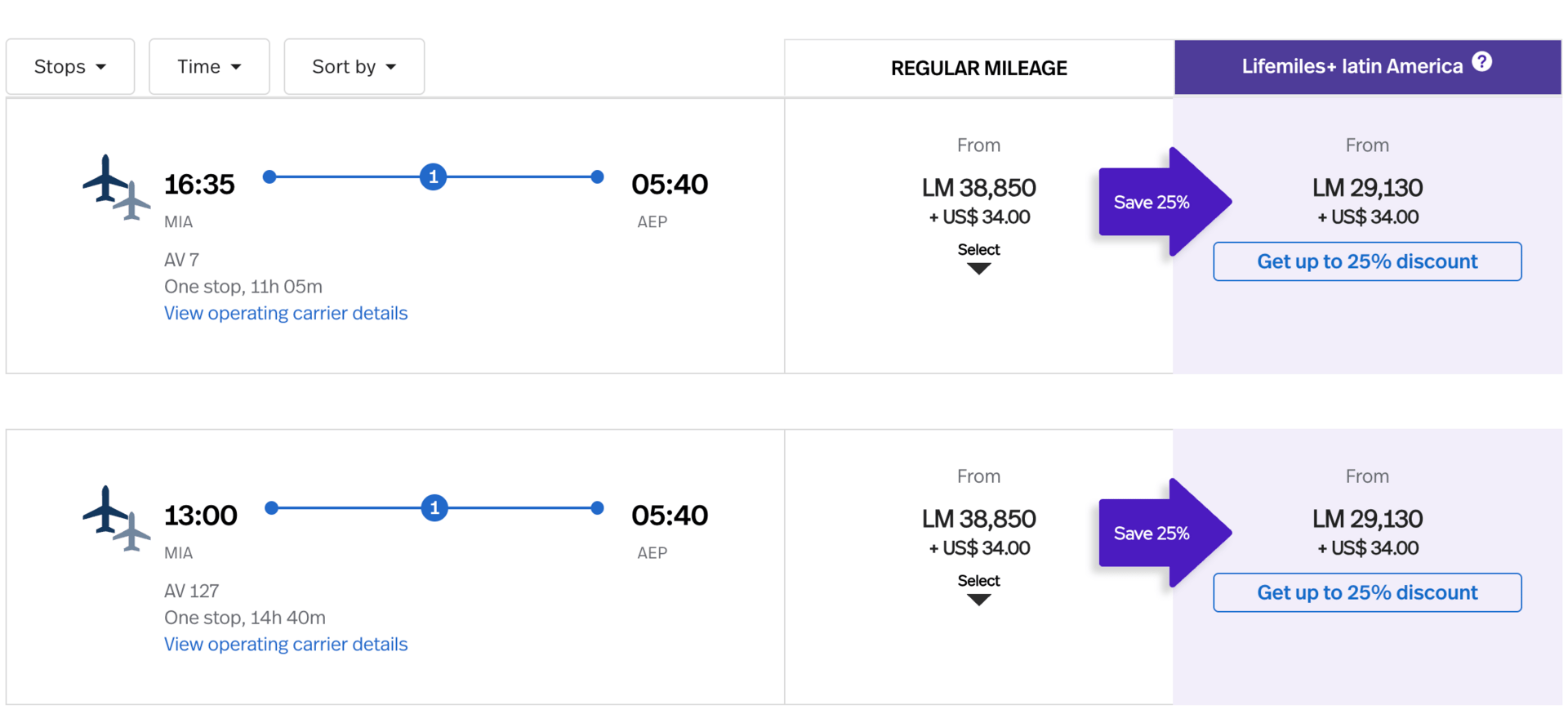

South America travel is highly overlooked, and your Capital One miles can do wonders here, too. Flights to Santiago or Buenos Aires often cost anywhere from 16,000 to 40,000 miles one way through Avianca LifeMiles, which Capital One also transfers to at a 1:1 ratio.

Miami (MIA) to Santiago (SCL) for 15,350 Avianca LifeMiles

And thankfully, taxes are pretty reasonable.

Here are some example prices for flights from Miami to Buenos Aires for less than 40,000 LifeMiles one way in economy.

Miami (MIA) to Buenos Aires (AEP) for 38,850 Avianca LifeMiles

Once you’re there, the $250 travel credit becomes incredibly useful. Regional flights, a couple of hotel nights, or a rental car in Patagonia all qualify when booked through Capital One Travel.

In this case, the miles get you onto the continent, and the credit helps you explore.

✨ Take Note: Viator has some incredible guided tours all over the world, and it’s a great way to use your Capital One travel credit.

4. Iceland

Iceland is famously expensive on the ground, which makes it a great candidate for a mixed strategy.

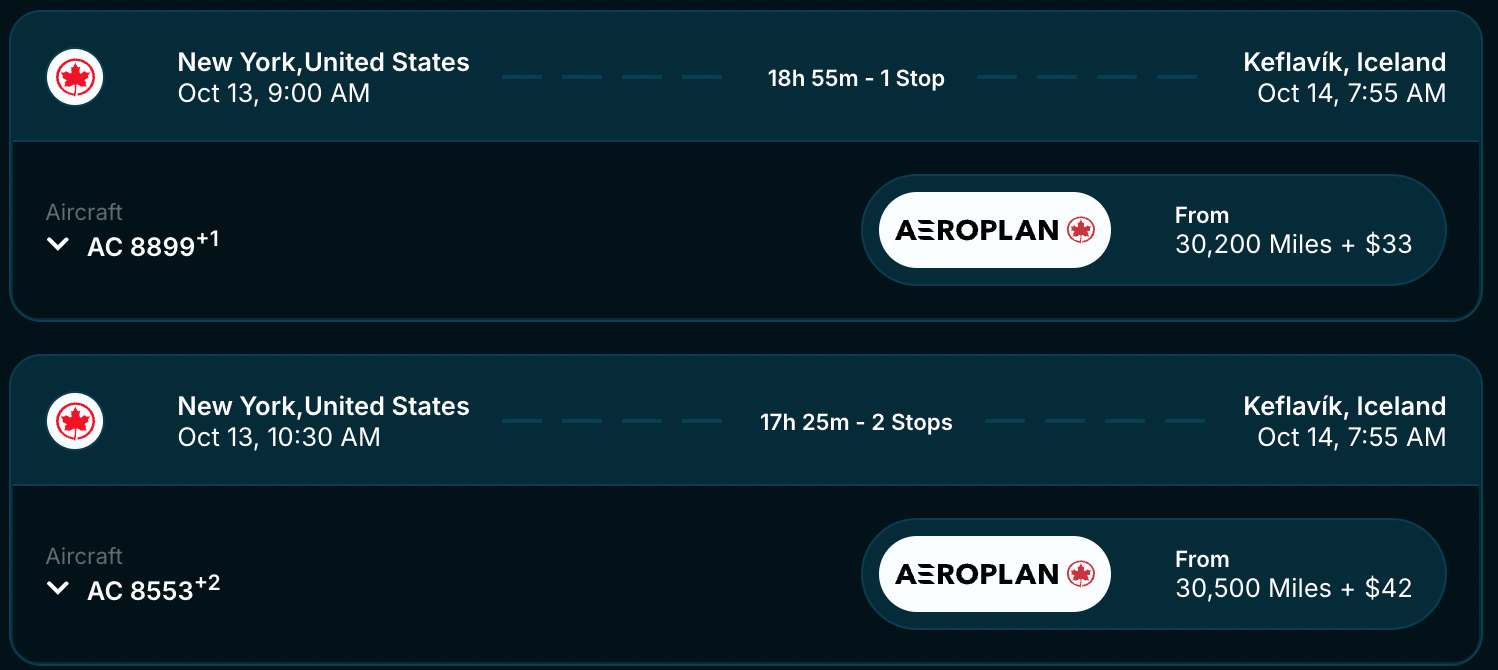

Flights from the East Coast can often be booked using Avios, sometimes for less than 25,000 miles one way, depending on the route and partner airlines. Capital One also transfers to Aeroplan at a 1:1 ratio, which can be a good option with lower fees.

Example of New York (JFK) to Iceland (REF) for just over 30k Aeroplan points

Once your flights are covered with miles, the $250 travel credit could, again, be used for things like rental cars, hotels, tours booked through Capital One Travel, and so on.

🌟 Pro Tip: Iceland is perfect for a short stopover. Three to four nights is plenty and much easier to manage with points and credits working together.

5. Maine Getaway

Not every great redemption involves crossing an ocean. For all my domestic homies out there, Maine is an excellent option.

Maine in the summer or fall is a perfect example of when Capital One miles are better used like cash. Flights to Portland are often reasonably priced, especially from the East Coast region. Book the ticket, and then cover it with the miles after.

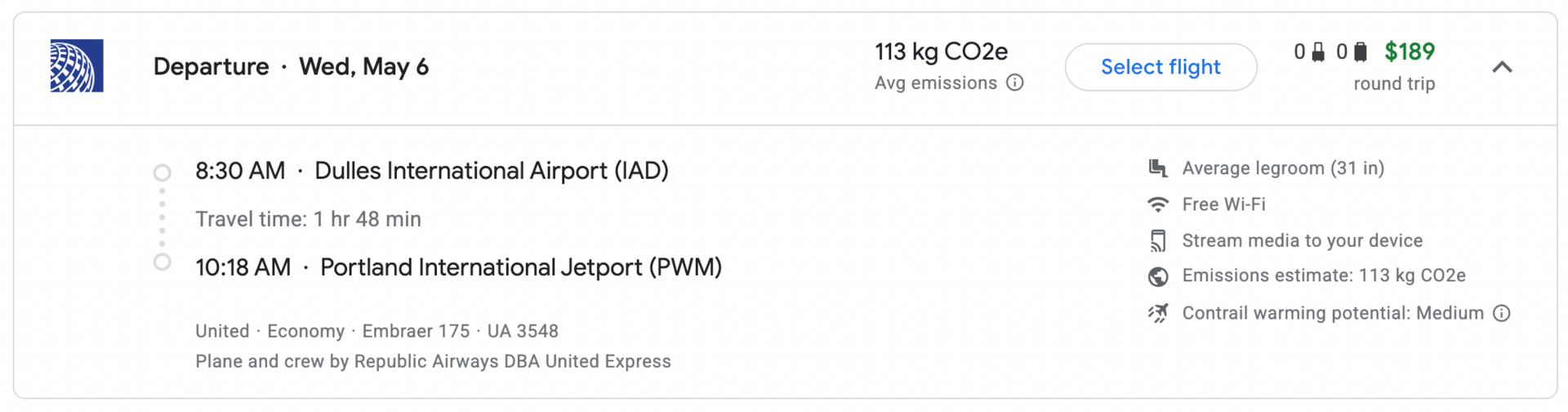

For example, you could fly round-trip from Washington, D.C. to Portland, Maine, for just $189 per person. If you booked that flight for two people, but wanted to cover it with points after the fact, it’d essentially cost you 37,800 Capital One miles.

IAD to PWM for $189 round trip on United

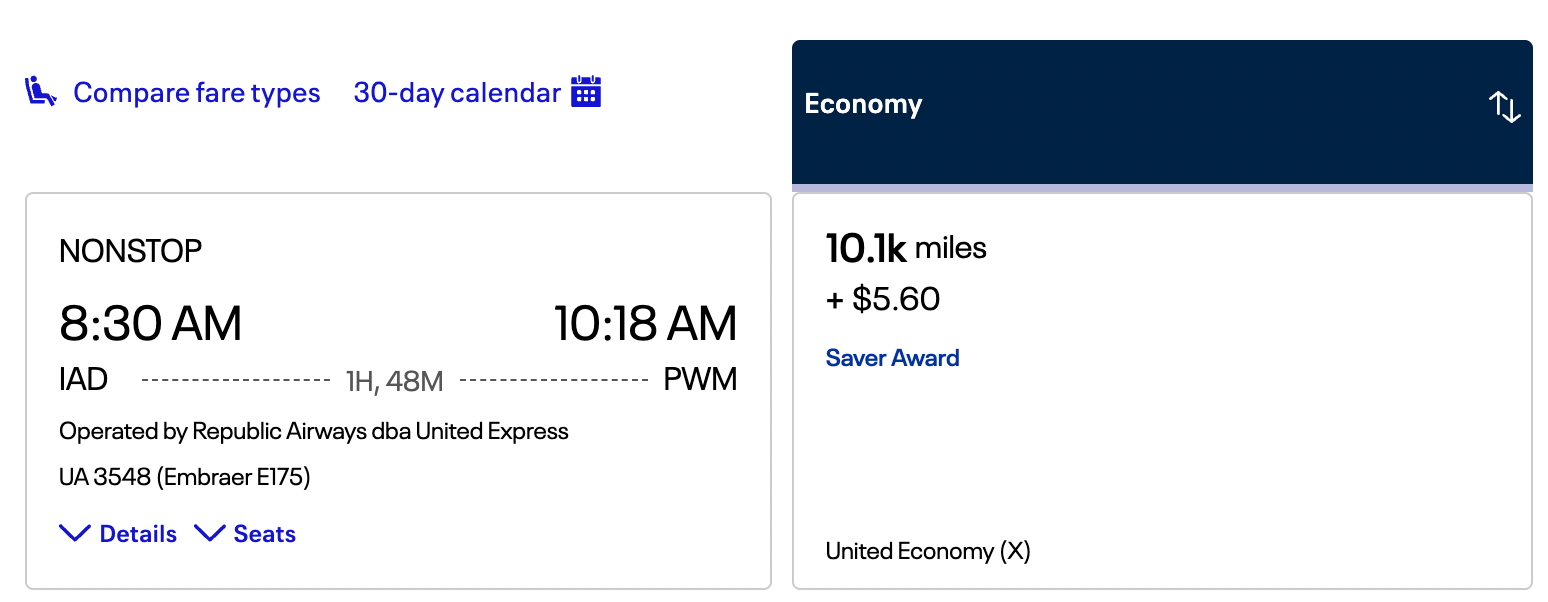

This same exact route on United will run you a minimum of 10k miles each way (plus the $6 taxes per leg per person).

Same IAD to PWM route with United Miles

In that case, you’d be paying 42,800 United miles (plus about $23 in taxes and fees) for the same exact route. If you used Capital One miles instead, you’d save 5,000 miles.

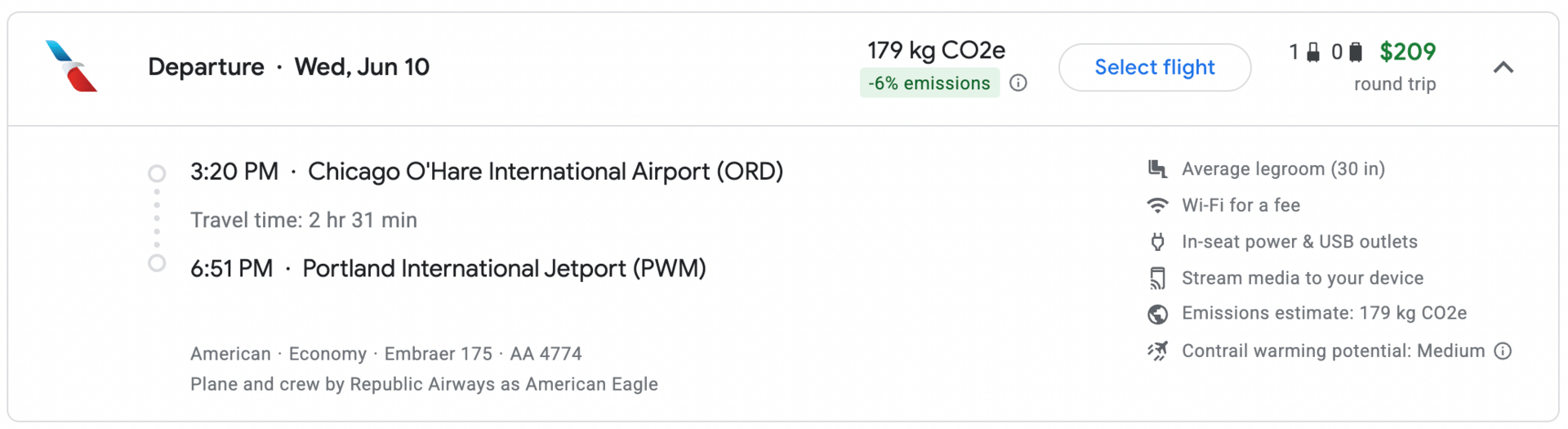

Let’s try that again from Chicago. In this case, you could cover two round-trip flights for about 41,800 Capital One miles.

ORD to PWM for $209 on American Airlines

Either way, if we’re rocking with the math from earlier, you’d still have roughly 53,000 miles leftover — not to mention the credit.

That leaves the $250 travel credit free for:

a boutique hotel

a coastal inn

or a rental car to explore Acadia and nearby towns

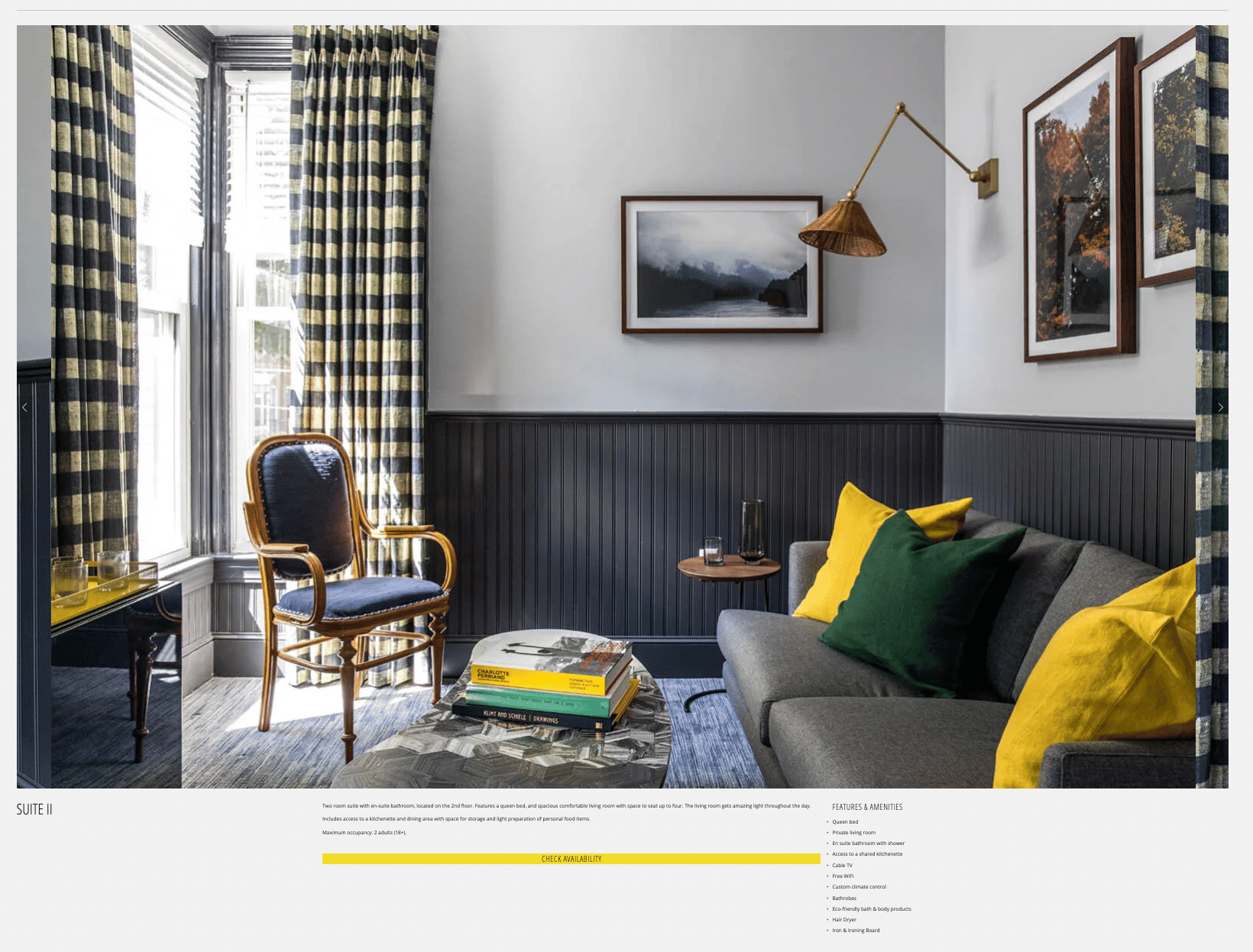

For example, you could book this super cute boutique hotel, the Mercury Inn, for just $150 per night, even in peak season.

Photo from www.mercuryinn.com

You could book one to two nights here using that $250 credit, and then cover the rest with your remaining miles. Realistically, the combination of those two things could cover around five nights at this specific inn.

So, for all of you craving a little domestic getaway, a little East Coast action could be the move. And, your Capital One miles could easily cover most (if not all) of your costs.

Capital One’s Most Useful Transfer Sweet Spots

One of the reasons Capital One miles are so easy to use is that they transfer to a group of very powerful airline programs, all at a 1:1 ratio.

Here are the big ones:

Air Canada Aeroplan: a go-to for Europe and Asia, with reasonable pricing, lower fees, and tons of partner options (including Lufthansa and ANA)

Flying Blue (Air France/KLM): one of the most beginner-friendly programs, known for monthly Promo Rewards and excellent availability to Europe

Avios (British Airways and Finnair): great for shorter flights and East Coast-to-Europe routes; Capital One is currently the only major bank that transfers 1:1 to Finnair Avios

Virgin Atlantic Flying Club: a fan favorite for cheap economy flights to the U.K. and solid Delta redemptions, especially when transfer bonuses pop up

🧠 Pro Tip: If award space is bad or cash fares are low, skip the transfer and use your miles like cash instead.

Smart Card Pairings With Venture

The Venture Card is strong on its own, but it pairs especially well with a few others.

Venture Card and SavorOne Rewards from Capital One: Use your SavorOne Rewards Card for dining, groceries, and entertainment, then convert those rewards into Capital One miles.

Venture Card and a Hotel Card: Capital One miles are excellent for flights and flexible travel costs. Hotel cards are great when you want better value on your stays. Using Capital One miles to get there (and a hotel card for where you sleep) is often the most valuable setup.

The common theme here is flexibility. The Venture Card doesn’t lock you into one strategy, and it plays well with almost everything.

Bottom Line

The new Venture Card offer isn’t necessarily about chasing the highest cents-per-mile number, but it’s about having options.

You can transfer miles when award space is good, use these miles like cash when it’s not, and layer in the $250 travel credit wherever it makes the biggest difference.