🌎 TRENDING TRAVEL NEWS 🌎

• Trip Planning: Looking ahead to 2026? Nat Geo’s Best of the World list just dropped.

• Security Update: Flying soon? TSA touchless ID is expanding to more airports.

• Safety First: These are the best countries to retire abroad in 2026.

• Readers Voted: These are the best U.S. cities for shopping right now.

Good morning from Kolkata – where the weather is cool, the food is absolutely amazing, and the air is literal poison. 😷

Like a Kolkata breeze, this newsletter is going to take your breath away (but in a good way):

✈️ How to turn taxes into a free trip

Well, people - 2025 has come and gone, as years tend to do. The new year is always a time full of whimsy, hope, and joy.

That is… until you get your fat tax bill and have to shell out your hard-earned dollar bills to the government.

BOOOOO. 👎

That’s right, folks… it’s time to pay the piper.

But whether you like to pay your taxes early in the year or wait until the last possible second, I’ve got some tips today that might eliminate some of the dread around the subject of paying taxes.

As someone who has owned a business and done lots of freelance self-employment work, I know the pain of having to pay big quarterly or annual tax bills, even when you plan for it.

What you may not know, however, is that there are ways to profit massively from your tax payment and even turn it into a luxurious business-class flight... 😮

Allow me to explain:

You may be aware that you can pay taxes using a credit card, usually with a pretty sub-optimal fee attached.

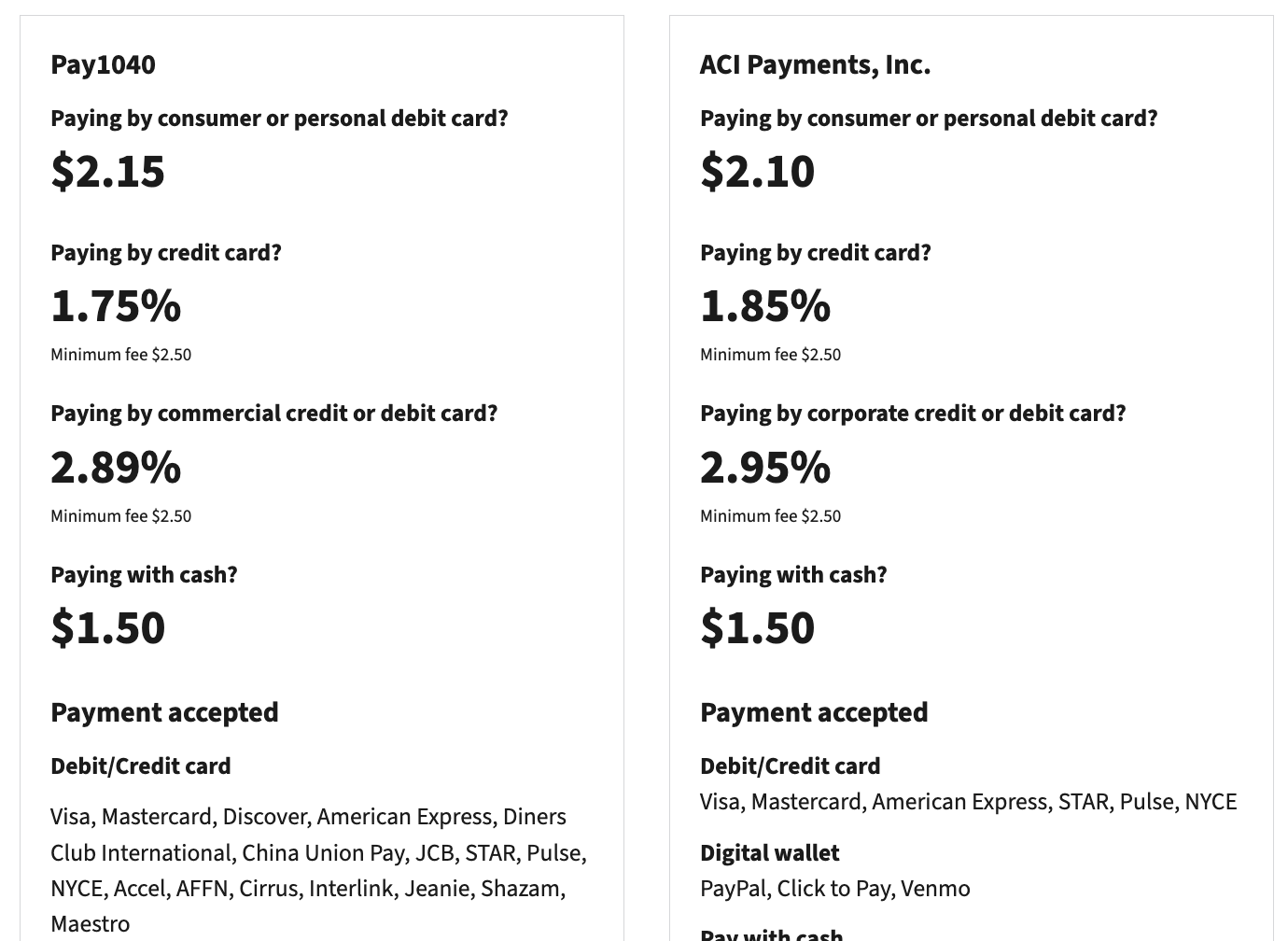

For example, the IRS website gives you multiple options for different payment processors, along with the various fees for different payment methods.

All of them will charge you just 1.75-1.85% in fees to pay with a credit card. For the sake of this example, let's conservatively call it 2%.

Let's say you rack up a $10,000 tax bill. This is not unreasonable for freelancers, small business owners, and others with supplemental income.

The 2% fee would mean you would have to pay an additional $200 just to use a credit card.

In most cases, paying more money to earn more points is a dangerous road to go down. But in the following two scenarios, it can be very worthwhile.

Scenario 1: Earning a welcome offer

You might be reluctant to sign up for expensive credit cards even when they have huge welcome offers due to the minimum required spending.

For example, the American Express Platinum Card® has a big-boy welcome offer and tons of great perks, but requires you to spend $8,000 to get the bonus.

But if you have a $10,000 tax bill, you'd eliminate that spending requirement in one swoop.

If you want to take this to the next level, you could open the Capital One Venture X Rewards Credit Card AND the Chase Sapphire Preferred® Card.

Since the combined minimum spend is under $10,000, you'd earn both welcome offers and get nearly 150,000 points (including points from your spend)… 🤯

That’s enough to book an entire trip somewhere!

Is a free trip abroad without stressing or waiting to earn points worth $200? For most of you, I'd guess the answer is yes.

Scenario 2: Normal points earning

Let's say you already have a credit card open, have already earned the welcome offer, and are really skeptical about shelling out $200 on fees just to earn some points from your taxes.

There are still ways for this to be worthwhile, believe it or not.

For example, if you own our highest-rated travel card, the Venture X, or even the Capital One Venture Rewards Credit Card, you earn a minimum of 2 miles per dollar on every single purchase.

That means your $10,200 purchase would earn you 20,400 miles on either of those cards.

If you then transfer those miles to Flying Blue, you could book an entire flight to Europe worth twice the fee you paid just for paying your taxes... it doesn’t get much better than that, my friends.

In this scenario, you're paying $200 because you know the points you earn can get you flights or hotels worth WAY more than that price.

That doesn't mean that $200 is free or that you aren't spending it. Rather, you're investing in something far more valuable.

So here’s the bottom line:

Now that 2025 has ended, it's important to start strategizing about maximizing your tax payments when the time comes.

Who knew paying your taxes could be so fun, eh?

SPONSORED BY SURFSHARK

🔒 The travel tool I didn’t realize I needed

I spend an embarrassing amount of time booking flights, checking bank apps, and logging into everything while traveling… usually on Wi-Fi networks called things like “Free_Airport_WiFi_2.”

Which… not comforting. 🙃

That’s where Surfshark steps in.

Image by Surfshark

With one tap, my connection is encrypted, my location is masked, and suddenly I’m way less worried about who else might be lurking on the same café Wi-Fi while I’m checking account balances or booking my next flight.

It also means I can flip my virtual location back home when I’m abroad, so streaming, apps, and websites work the way they’re supposed to (yes, including Netflix when the hotel TV isn’t hitting).

A few things I love:

It works on unlimited devices at once — phone, laptop, tablet, partner’s phone, mystery iPad from 2018

It blocks ads, trackers, and sketchy sites in the background

Surfshark doesn’t log or track what I do online (a very underrated perk)

Whether you’re hopping between countries or just working from a random coffee shop, this is one of those set-it-and-forget-it tools that makes travel smoother and way safer.

👉 Go to surfshark.com/dailydrop or use code DAILYDROP at checkout to get 4 extra months of Surfshark VPN

(Plus, there’s a 30-day money-back guarantee if you want to test it out risk-free.)

🎥 Bilt 2.0, explained

Here at Daily Drop, we love Bilt Rewards points. They’re harder to earn than most other currencies, but they’re also more valuable.

But if you’ve been a Bilt cardholder, you’re probably stressin’ out about all the drama…

Bilt is changing card issuers and launching a bunch of new cards this month, and it’s a bit confusing.

So in this week’s Daily Drop YouTube video, we’ll break down how exactly this transition works.

And later this week, we should have more concrete details on what each individual new card actually looks like in terms of benefits and everything else.

That’s all for today, my friends. I hope this newsletter got you somewhat excited for tax season (or at least excited for your free tax-funded trip).

Next time you hear from me, I’ll be in a new country in a different (hot) part of the world.

See you then ✌️

With contributions by McKay Moffitt